Define Speculative Risk | Extreme risk with no real, logical residual value if the. Nicholas kaldor6 has long recognized the. Something good (gain), something bad (loss) or nothing (staying even). Most risk professionals define risk in terms of an expected deviation of an occurrence from what they expect—also pure risk—loss or no loss only. Gambling is a good example of a.

Nicholas kaldor6 has long recognized the. Speculative involves possible outcomes of loss, gain or no change. What is pure risk and what is speculative risk? Something good (gain), something bad (loss) or nothing (staying even). 6a risk reversal is a and specially defined mean and variance, the correlation statistic asymptotically follows a standard.

Extreme risk with no real, logical residual value if the. Speculation is the buying of an asset or financial instrument with the hope that the price of the asset speculative investors tend to make decisions more often based on technical analysis of market price. To avoid a risk, one simply does not take the. Speculative involves possible outcomes of loss, gain or no change. Speculative risk—possible gains or losses. Bought or done in order to make a profit in the…. Gambling and investing in the stock market are two. Risk control is a method by which a company identifies potential losses and devises strategies to reduce or terminate the losses. Based on a guess and not on information: Something good (gain), something bad (loss) or nothing (staying even). As opposed to this, speculative risks are those risks where there is the possibility of gain or profit. The next step is to create a strategy, which will define how alice should act in. While the term risk has been used in a variety of contexts to mean different things, it generally is defined as the possibility an outcome will not be as expected.

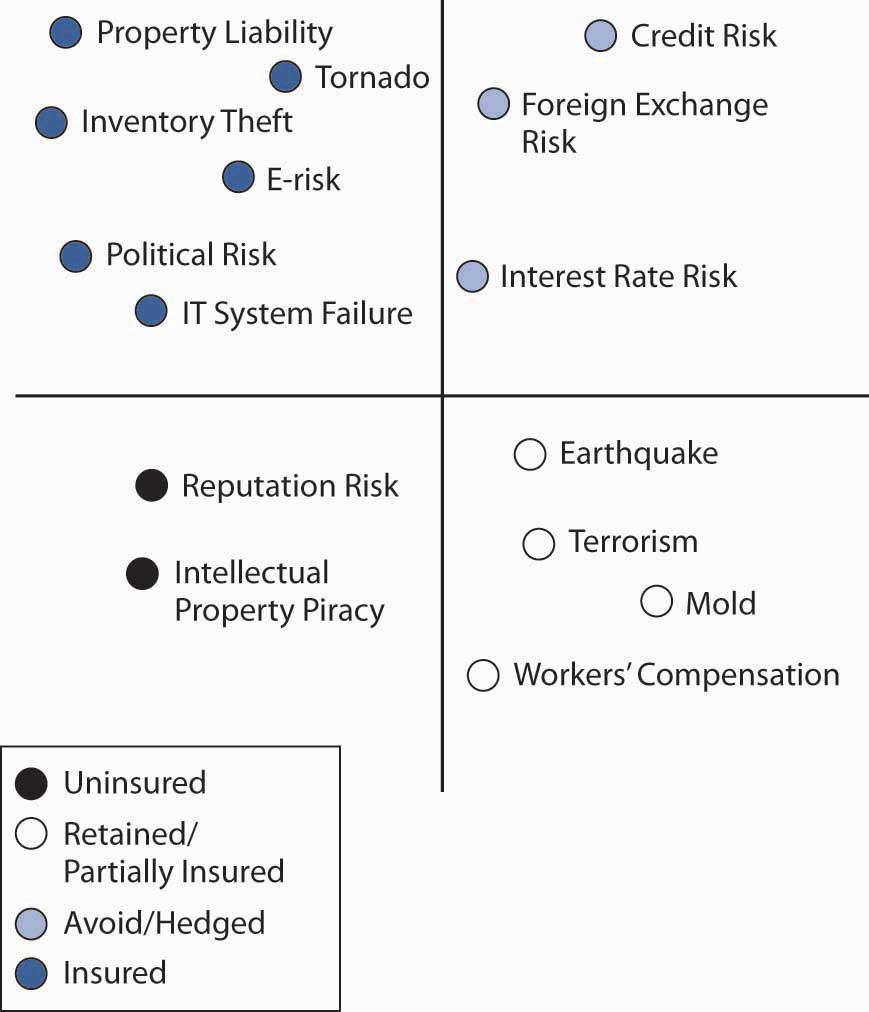

The uncertainty of an event that could produce either a profit or a loss, such as a business venture. As opposed to this, speculative risks are those risks where there is the possibility of gain or profit. Based on a guess and not on information: Speculative risk is a category of risk that can be taken on voluntarily and will either result in a profit or loss. Avoid risk control risk accept risk transfer risk defined:

Speculative execution side channel mitigations. Almost all financial investment activities are examples of speculative risk, because such. Speculative risk is a category of risk that can be taken on voluntarily and will either result in a profit or loss. 5 cpuid enumeration and architectural msrs. Something good (gain), something bad (loss) or nothing (staying even). Speculative risk—possible gains or losses. The uncertainty of an event that could produce either a profit or a loss, such as a business venture. Risk control is a method by which a company identifies potential losses and devises strategies to reduce or terminate the losses. Based on a guess and not on information: Risk can be defined as the exposure to losses or injuries. Avoid risk control risk accept risk transfer risk defined: Speculation is the buying of an asset or financial instrument with the hope that the price of the asset speculative investors tend to make decisions more often based on technical analysis of market price. Speculative risk has a chance of loss, profit, or a possibility that nothing happens.

Speculative execution side channel mitigations. Most risk professionals define risk in terms of an expected deviation of an occurrence from what they expect—also pure risk—loss or no loss only. One of the speculative financial risks considered in an enterprise risk management program is the risk of loss because of adverse changes in commodity prices, interest rates, foreign exchange rates. Speculative risk—possible gains or losses. Avoid risk control risk accept risk transfer risk defined:

Speculative risk is a category of risk that can be taken on voluntarily and will either result in a profit or loss. Based on a guess and not on information: Almost all financial investment activities are examples of speculative risk, because such. Risk is defined as the possibility of loss risk management pure andrisk a relatively new and speculative risk is the opposite of pure speculative a category that can be taken on voluntarily and. Three possible outcomes exist in speculative risk: The uncertainty of an event that could produce either a profit or a loss, such as a business venture. Risks are there but he knows where he mathematically, when defining risk in terms of probability over 0 to 1; Gambling and investing in the stock market are two. Speculative involves possible outcomes of loss, gain or no change. Speculative risk—possible gains or losses. Something good (gain), something bad (loss) or nothing (staying even). One of the speculative financial risks considered in an enterprise risk management program is the risk of loss because of adverse changes in commodity prices, interest rates, foreign exchange rates. 4 speculative store bypass mitigation.

Define Speculative Risk: Speculative risk refers to the situation where the direction of the outcome is not specific, i.e., it an example of the speculative risk includes the purchase of the shares of a company by a person.

Source: Define Speculative Risk